〜A roadmap for "vacant house countermeasures" that should be completed while the baby boomer generation is still healthy〜

*This article is based on the latest statistics and legal systems as of December 2025.

There is a saying that "wise men learn from history, fools learn from experience." If we apply this to the real estate situation in modern Japan, we might say that "wise men learn from changes in the legal system and demographics, while fools cling to past success stories (land myths)."

During the period of rapid economic growth after the war, owning one's own home was the "goal of a middle-class family" and the royal road to asset formation. At the center of this trend were the "baby boomers" born between 1947 and 1949. However, times have changed dramatically and cruelly, and these once glorious assets are on the verge of turning into "liabilities" that will bind the next generation unless appropriate measures are taken.

The mandatory inheritance registration that came into effect on April 1, 2024, and the "2025 Problem" in which all members of the baby boomer generation will be elderly (75 years or older) in 2025, are not just news but a serious warning signal for protecting personal assets.

This article will detail the "end-of-life planning for the home" that baby boomers should complete while they are still alive, based on cold, hard data and economic rationality, and excluding emotional arguments and wishful thinking. This is not just about sorting out real estate, but is the final and most important project to protect your family.

1. The intersection of the baby boomer generation and the "era of large inheritances": Shifting from assets to risks

The reality in numbers: The impact of 9 million homes and the accumulation of "negative assets"

First, we need to understand the current situation we are facing with objective figures. The results of the "2023 Housing and Land Survey" published by the Ministry of Internal Affairs and Communications in 2024 sent shock waves through the real estate market.

The number of vacant homes nationwide has reached a record high of 9 million, and the vacancy rate (ratio of vacant homes to the total number of homes) has reached a record 13.8%. However, what is noteworthy here is not just the total number, but the change in the "contents" of the homes.

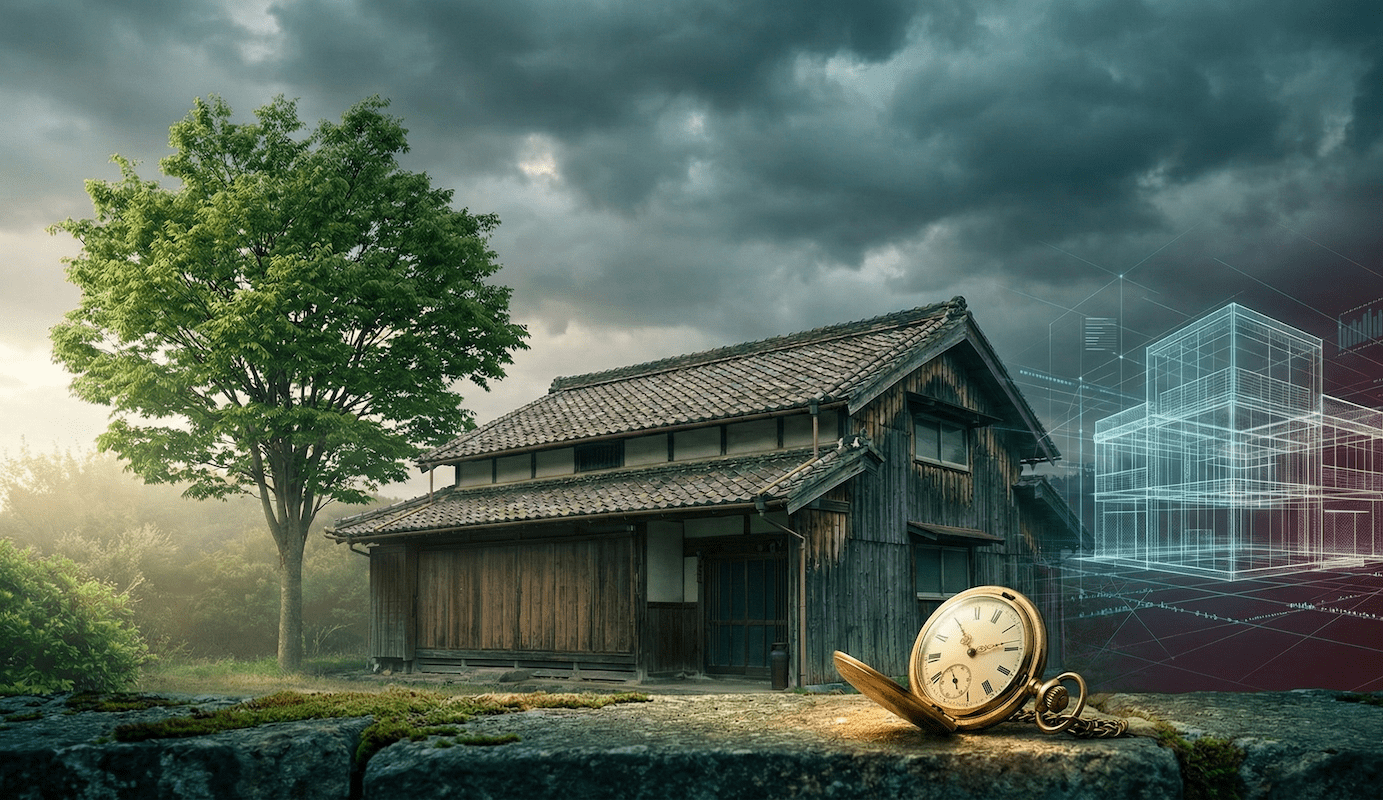

[Figure 1] Trends in the number of vacant houses and "other vacant houses" (1993-2023)

As the chart above shows, there has been a sharp increase in "other vacant homes," which are abandoned with no use, rather than vacant homes on the market for rent or sale. In 1993, there were approximately 1.49 million vacant homes, but by 2023, this number had ballooned to 3.86 million, or about 2.6 times the number. This suggests that "negative assets," where market principles do not function, are piling up in Japan's residential areas.

The houses in new towns purchased by the baby boomer generation are now 40 to 50 years old and have almost no physical value. Meanwhile, their children (baby boomer juniors) are not returning to their parents' homes due to a return to urban areas and the trend toward nuclear families, creating a definite mismatch between supply and demand.

April 2024: A legal paradigm shift

Traditionally, real estate registration and management were left to the voluntary will of the owner (private autonomy). However, in response to the situation where the issue of ownerless land was hindering public works and disaster recovery, the government made a major shift toward making it "mandatory and penal."

The revised Real Estate Registration Act, which came into effect on April 1, 2024, solidifies this trend. The changes that will have a direct impact on the baby boomer generation and their heirs are as follows:

| Mandatory items | Enforcement date/deadline | Penalties (fine) |

|---|---|---|

| Mandatory application for inheritance registration | Effective April 1, 2024 From the day you learned about the acquisitionWithin 3 years | If you neglect without a valid reason Fine of up to 100,000 yen |

| Mandatory registration of address and name changes | Effective April 1, 2026 From the date of the changeWithin 2 years | If you neglect without a valid reason Fine of up to 50,000 yen |

*Please note that this will also apply retroactively to unregistered land inherited in the past (the grace period is until March 31, 2027).

A situation has arisen where "I didn't know" is no longer an excuse. If the baby boomer generation leaves land in the name of their parents (born in the Meiji and Taisho eras), the next generation will inherit it, along with the risk of being fined.

2. International comparison highlights Japan's "abnormalities"

Why are vacant house rates so low in Europe and the United States?

To understand the seriousness of the vacant house problem in Japan, it is useful to compare it with other countries. Western countries are also facing population decline and changes in urban structure, but their vacant house rates are kept lower than Japan's.

The vacant house rate in Germany is said to be around 1.01 TP3T to 4.31 TP3T, while the long-term vacant house rate in the UK (England) is said to be around 11 TP3T (varies depending on statistical standards). Why are there such large differences? Behind this lies the thorough belief that "ownership comes with obligations" and the strong power of government intervention.

In the UK, under the Housing Act 2004, local authorities can intervene without the owner's consent if a home has been vacant for more than six months without a valid reason."EDMO (Empty Dwelling Management Orders)"There is a system called ``.''

Local governments can forcibly acquire management rights, repair the properties using public funds, rent them out to homeless households, and recover repair costs from the rental income. Owners fear the risk of their properties being rented out without their consent, and this creates an incentive for them to take the initiative to use or sell the properties.

Germany, especially in urban areas such as Berlin and Hamburg, strictly restricts the use of housing for purposes other than residential use (including leaving it vacant).“Law on Prohibition of Use for Other Purposes (Zweckentfremdungsverbot)”is being enforced.

If you leave a room vacant for more than three months without a valid reason, you may be subject to a maximum500,000 euros (approximately 80 million yen)In addition, permission is required for the demolition of buildings, and strict maintenance obligations are imposed on owners.

In response to this, Japan has long been extremely cautious about coercive measures such as administrative execution, due to consideration for individual property rights (Article 29 of the Constitution). However, it is certain that discussions on European-style "direct penalties for mismanagement" will accelerate in Japan in the future. The current 100,000 yen fine should be seen as merely the beginning.

3. The cost of maintaining the status quo: Break-even points for proponents vs. opponents

Many owners put off the problem for reasons such as "demolition costs are high," "property taxes will increase," or "someone might use it someday." However, this lack of economic rationality is due to a "status quo bias." We will specifically examine the costs and risks of leaving the property abandoned.

Cash flowing into unproductive assets

Maintaining a vacant house at a legally acceptable level incurs the following annual costs, which amount to a loss of several million yen over a 10-year period.

| item | Estimated annual cost | Contents and risks |

|---|---|---|

| Fixed asset tax, etc. | 50,000 to 150,000 yen | As long as there is a building, the land tax is reduced to 1/6,Up to six times the amount of "specific vacant houses" designatedThere is a risk of. |

| Fire insurance premiums | 30,000 to 100,000 yen | Vacant houses are at higher risk of arson and are more expensive than regular houses. In the worst case scenario, they may be refused. |

| Maintenance and management costs | 120,000 to 240,000 yen | Basic utility fees, garden tree pruning, weeding, transportation costs, etc. Costs for dealing with complaints from neighbors. |

| Total (annual) | Approximately 200,000 to 500,000 yen | Accumulated deficit of 2 million to 5 million yen over 10 years |

Advantages of early action (demolition, sale, trust)

On the other hand, there are clear economic benefits to taking action early.

- Utilizing the 30 million yen special deduction:If you inherit a vacant house and either retrofit it to make it earthquake-resistant or demolish it and sell it as a vacant lot, there is a special exemption that allows you to deduct up to 30 million yen from your capital gains. However, there are strict requirements: the house must have been built before May 31, 1981, and the property must have been sold within three years of the start of the inheritance.

- Dementia prevention measures (family trust):If you enter into a family trust agreement while your parents are still healthy, your children will be able to sell their assets at their own discretion even if they develop dementia. This is the strongest insurance against asset freezing.

4. Threats in specific areas: Lessons from Toyako Town, Hokkaido

The risk of vacant houses has completely different implications in urban and rural areas, especially in cold regions. Examples such as Toyako Town in Hokkaido, which is popular as a resort destination but also has harsh weather conditions, teach us the horror of physical risks.

Fear of "physical destruction" caused by snow and ice

While vacant houses in Honshu "gradually decay," vacant houses in areas with heavy snowfall are at risk of "collapse within one winter."

First of all, if you neglect to remove snow from your roof, the weight of several tons can cause your house to collapse. The cost of removing snow can range from tens of thousands to hundreds of thousands of yen each time. The maintenance costs of repeating this every winter are enormous. Even more frightening is the possibility of water pipes freezing. Draining water is essential for homes in Hokkaido, but if water remains in the pipes, they will freeze and burst.

When spring comes and the snow melts, water will gush out from the ruptured area, flooding the floor and causing the foundation to rot. If this happens, the asset will have absolutely no value and repair costs alone will cost hundreds of thousands of yen.

Market polarization and exit strategies

In areas with inbound demand, such as around Lake Toya, properties with favorable conditions, such as "viewing the lake" or "being along a major road," are traded at high prices. However, properties further out in the country with poor conditions become "negative assets" that even local residents avoid.

For such properties, the best course of action is to take advantage of local government subsidies for demolishing vacant houses (such as the maximum of 300,000 yen in Toyako Town), and in some cases consider "free transfer" or the "inherited land transfer system to the national treasury (subject to a fee)" and get rid of them as soon as possible.

5. Recommendations and Roadmap for the Baby Boomer Generation

Finally, provide a concrete plan of action. Time is a seller's biggest enemy.

Phase 1: Understand the current situation and confirm your intentions (now)

Hold a family meeting and ask your children if they want to live in the family home. Have the courage to get them to say "No." Then, check the land registry to see if the property is still in the name of the previous generation.

Phase 2: Asset sorting and legal preparations (within one year)

Compare the annual maintenance costs with the future sale price, and if there is a deficit, it should be subject to "immediate disposal." If there are concerns about the parent's cognitive function, consult a judicial scrivener and transfer management rights to the child through a "family trust."

Phase 3: Implementing an exit strategy (within three years)

The property will be demolished and sold within the 30 million yen special deduction period. If no buyer is found, the property will be donated to a neighboring property or registered in a vacant house bank, and any other effort will be made to give up ownership.

Conclusion: To leave your home beautiful and preserve its memories

Peter Drucker once said, "The best way to predict the future is to create it." This statement carries weight when it comes to planning for the end of life of your home.

Rather than lamenting the future after inheritance, people are being asked to create a "beautiful ending" with their own hands now. Statistically speaking, the baby boomer generation does not have much time left to retain their decision-making capacity.

Will you leave your children a "negative legacy" and the "risk of legal fines," or will you leave them organized "asset that will be appreciated"? We have already entered an era where choosing to "do nothing" will ultimately destroy family ties and cause trouble for the local community.

Your decision can change your future. Start by picking up your estate register and talking with your family.

Related Links

- Ministry of Justice: For those who have inherited real estate - Procedures for inheritance registration, estate division, etc.

- Statistics Bureau, Ministry of Internal Affairs and Communications: Summary of the results of the 2023 Housing and Land Survey

- Ministry of Land, Infrastructure, Transport and Tourism: Information related to the Special Measures Act on the Promotion of Measures against Vacant Houses, etc.

Inquiries and requests

We help solve local issues.

Please feel free to contact us even if it is a small matter.