~Why is adoption progressing? Understanding the future from the example of Toyako Town, Hokkaido~

*This article is based on information as of December 2025.

"I tried to book a family trip for the first time in a while, but the total price was higher than I expected..."

In fact, if you look closely at the bill, in addition to the accommodation fee and service charge,"Accommodation tax"More and more people are becoming aware of the additional tax. In the past, this was only a concern in some large cities such as Tokyo and Osaka. However, this "accommodation tax" is now sweeping across the Japanese archipelago from north to south.

In Hokkaido, a major tourist destination, the system is scheduled to be introduced throughout the region from 2026, making it an unavoidable topic that directly affects our travel budgets and styles.

So why increase taxes now?

Furthermore, there are endless questions, such as, "Is the money collected really being used for tourism?" and "Is Japan expensive or cheap compared to other countries?"

In this article, we will thoroughly answer these questions by providing expert insights in an easy-to-understand manner, including the unknown history and mechanisms of accommodation taxes, surprising circumstances overseas, and the latest notable case study: the challenges faced by Toyako Town in Hokkaido.

1. What is the accommodation tax? Its origin and how it differs from the "hot spring tax"

It has been "common sense" around the world for 100 years

Accommodation taxes have only been a topic of discussion in Japan for the past 20 years or so. However, their global history is surprisingly long, dating back to France in 1910.

Its origins are said to lie in the "sightseeing tax (taxe de séjour)" that was introduced in French spa resorts at the time. In other words, the idea of tourists paying a portion of the cost of using local infrastructure (roads, water, parks, etc.) has taken a long time to take root in Europe and the United States. As a result, more than 90% of local governments in France now have this system in place.

The dawn of Japan began with the "Ishihara administration"

Meanwhile, the history of accommodation tax in Japan began in 2002 (Heisei 14). It was introduced by Tokyo Metropolitan Government. Specifically, under the strong leadership of then-Tokyo Governor Shintaro Ishihara, it was established as a source of revenue to realize Tokyo as an "international tourist city."

When it was first introduced, there was fierce opposition from the accommodation industry and the business community, with people saying things like "it will decrease the number of tourists" and "it will put a damper on the economy." However, when the numbers actually increased, the number of tourists actually increased steadily. In fact, it has now become a stable source of revenue of several billion yen per year, and is an important pillar supporting Tokyo's tourism infrastructure.

Subsequently, against the backdrop of a rapid increase in inbound tourism (foreign tourists visiting Japan), the service spread like dominoes to major tourist cities, including Osaka Prefecture in 2017, Kyoto City in 2018, Kanazawa City in 2019, and Fukuoka Prefecture and City in 2020.

Common Misconception: Difference from the "Bath Tax"

When you visit a hot spring resort, you have long been required to pay a "bath tax (about 150 yen per person per night)." This can lead to confusion, leading people to wonder, "Do we have to pay another tax on top of that?" However, the two are actually completely different taxes.

| item | Bathing tax (existing) | Accommodation tax (new) |

|---|---|---|

| Taxable | The act of bathing in a mineral bath (hot spring) | Staying at a hotel, inn, private lodging, etc. |

| Main uses | Firefighting facilities, environmental sanitation, tourism promotion, etc. *Limited uses |

Tourism promotion in general *Can be used for a wide range of purposes, including infrastructure, PR, and congestion control |

| history | 1950 onwards (immediately after the war) | 2002~ (New taxes of the 21st century) |

In short, the accommodation tax can be described as a "new, more flexible form of funding for managing tourist destinations."

2. How is the amount of the burden determined? "Flat rate" vs. "Fixed rate"

There are two main methods for calculating accommodation taxes. Depending on which method is adopted, the burden on travelers and the tax revenue for local governments will vary greatly.

This is a system in which a fixed amount is taxed for each range of accommodation fees, such as "100 yen for a night's stay of 10,000 yen or more."

- Recruitment:Many locations include Tokyo, Osaka, Kyoto, Kanazawa, and more.

- assignment:The tax amount is not much different whether you stay at a business hotel for 5,000 yen per night or in a super luxury suite for 500,000 yen per night. As a result, it has been pointed out that the burden on the wealthy is relatively light (regressive).

This is a tax system in which taxes are levied as a percentage of the fee, such as "2% of the accommodation fee."

- Recruitment:Kutchan Town, Hokkaido (Niseko area).

- merit:It is fair in that "people who stay in expensive rooms pay more." Furthermore, it is characterized by the fact that tax revenue increases automatically in line with rising prices and hotel rates, without the need to amend the ordinance.

[Latest Trends]

In fact, this trend is now changing. For example, Tokyo Metropolitan Government, a pioneer in the introduction of the tax, has begun considering switching from the current "flat rate" system to a "fixed rate" system. This is because, with accommodation costs soaring due to the weak yen and inflation, the actual value of the tax will decrease if the flat rate system remains in place. Therefore, it is possible that the "flat rate" system will become the standard in Japan in the future.

3. Is Japan too cheap? The shocking truth about "tourist taxes" around the world

It is natural to feel that an increase in taxes is a burden. However, from a global perspective, Japan's accommodation tax"Unbelievably cheap"It can be seen that...

Let's now simulate the amount of tax you would pay if you stayed at a fairly luxurious hotel for 50,000 yen per night (per person for two people sharing a room, or for a single person).

* Only 200 yen in Tokyo

As such, it is common knowledge in Western tourist cities that "10% to 15% of the accommodation fee is tax." From the perspective of inbound (foreign tourists), Japan's accommodation tax feels like "almost nothing." This is one of the reasons why local governments think, "If we ask tourists to pay a little more, the number of tourists won't decrease."

4. The Challenge of Toyako Town, Hokkaido, and the Wall of "Triple Taxation"

Currently, Hokkaido is the most noteworthy "frontline" in the discussion of accommodation tax. In particular, Hokkaido is visited by more than 2 million tourists a year."Toyako Town"This movement will be an important test for future regional tourism.

Why Toyako Town is aiming to introduce it

Toyako Town will begin full-scale consideration in 2024, aiming to introduce an accommodation tax from April 2026. The expected tax revenue isApproximately 145 million yen per yearis.

For a town with a small population and limited financial resources, this is an extremely large independent source of revenue. Specifically, the plan is to use the funds to preserve the precious natural environment that has been certified as a Global Geopark, to deal with abandoned buildings in the aging hot spring town, and to ensure secondary transportation (buses and on-demand transportation) to serve as transportation for tourists.

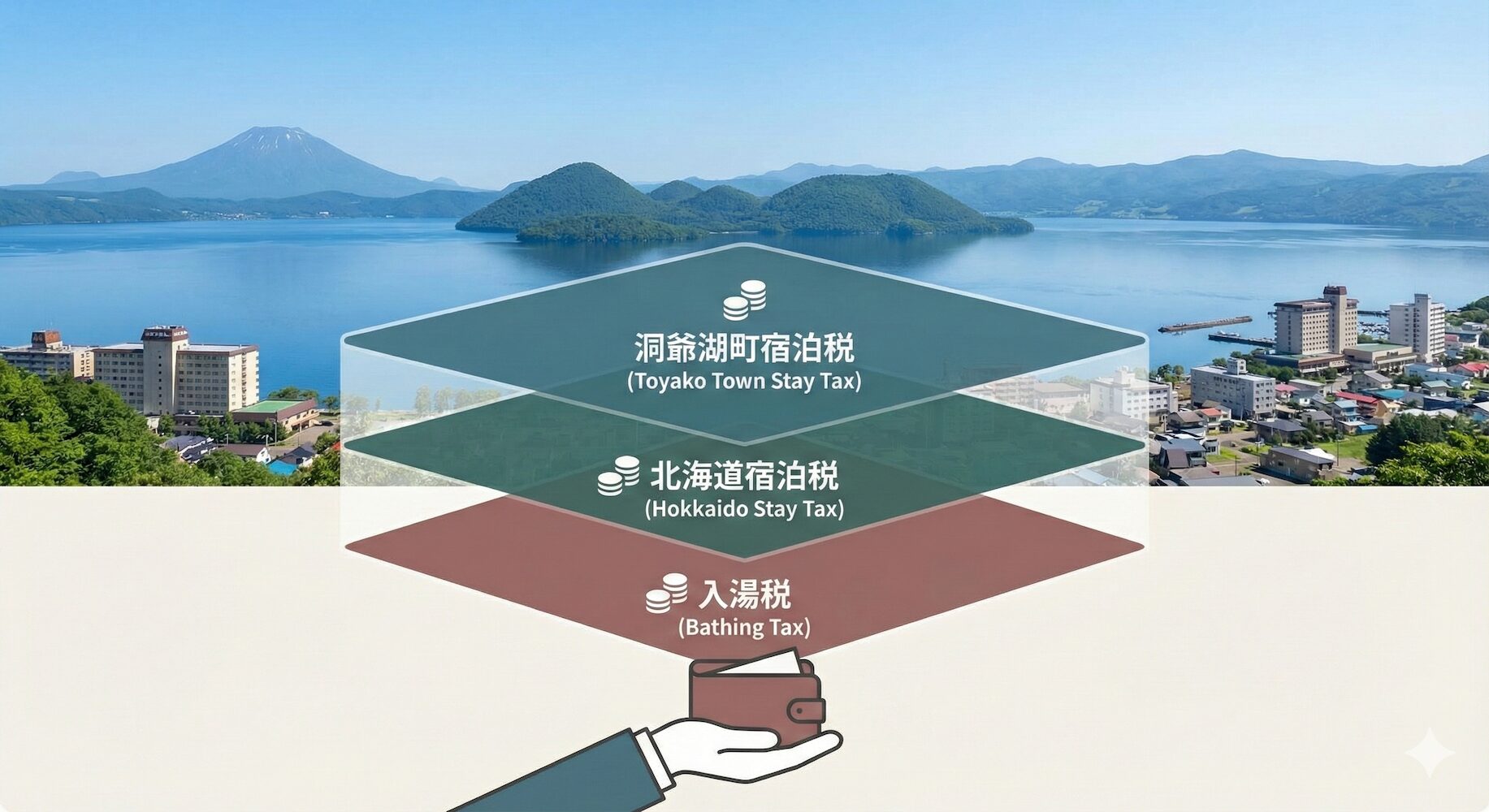

The looming "triple tax" problem

However, the implementation requires solving a very complex puzzle."Triple taxation"This is the problem.

In the vast area of Hokkaido, prefectures (prefectures) and municipalities each have their own roles. The Hokkaido government is also planning to introduce a uniform "accommodation tax (prefectural tax)" across the entire prefecture from 2026 in order to promote tourism across the region. This means that if you stay at Toyako Onsen from 2026 onwards, you may be subject to the following three taxes at the same time.

Increasing burden on travelers?

If you simply add up all of these, the tax burden per night alone comes to nearly 1,000 yen. Naturally, this can lead to complaints from travelers, who wonder, "Why do I have to pay so many layers of tax?"

The adjustment capabilities of the precedent example, the "Niseko Model"

To address this challenge, the Niseko area (Kutchan Town) has implemented a highly advanced"Adjustment deduction"Specifically, the system reduces the town tax so that the combined town tax and prefectural tax do not exceed the accommodation fee of 2%.

For example, let's consider a case where the accommodation fee is 20,000 yen (maximum 400 yen). If the prefectural tax is 200 yen, the town tax will be the remaining 200 yen. By doing so, the total burden will remain the same and be kept at 400 yen.

In Toyako Town, careful discussions are still ongoing about how to adjust for double taxation with the prefectural tax and how to balance it with the existing hot spring tax. Finding a "landing point" that is acceptable to tourists holds the key to the system's success.

5. Is the accommodation tax a "bad thing"? Weighing the pros and cons

Naturally, there are pros and cons to introducing a lodging tax. Let's take a look at the pros and cons, which vary depending on your perspective.

- Funding for measures against tourism pollution:As the number of tourists increases, costs such as garbage disposal fees and emergency response services skyrocket. It would be unfair to cover these costs solely through resident taxes. Therefore, an accommodation tax is a legitimate means of "beneficiary burden."

- Stable independent funding:Unlike subsidies from the national government, local governments are free to decide how to use the funds, allowing them to implement detailed policies that meet local needs.

- Increased administrative burden:Hotels must handle the tedious task of calculating and collecting tax rates, and the costs of updating their systems are a heavy burden, especially for small and medium-sized inns.

- Effective price increase:If you have a family of four staying, the cost can add up to several thousand yen per night.

- Distrust of the mission:This is the biggest risk. If people have doubts that the money collected under the pretext of "tourism promotion" will be lost to events with unclear effects, they will not cooperate with the system.

6. Outlook for the future: The day when taxes become "investment"

The accommodation tax system is moving from the stage of simply "collecting money" to the second phase of "how to make use of it."

Visualizing "use" is everything

Kyoto City is using the accommodation tax to increase the number of crowded city buses and remove utility poles to protect the landscape. The important thing here is to communicate this to tourists.

"This fireworks display is being held with your accommodation tax." "This comfortable Wi-Fi has been provided with accommodation tax."

As such, Toyako Town and other local governments that have adopted the system are strongly required to "visualize the results."

Utilizing the engine called "DMO"

In addition, rather than using collected taxes solely in the hands of government offices, there is a growing trend to entrust the money to expert groups such as DMOs (Distance Management Organizations) and invest in agile marketing and data analysis.

When travelers start to see the accommodation tax not as "money taken" but as "investment money for a better travel experience" or "membership fees for a local fan club," it will become a powerful engine that will propel Japan's tourism to the next level.

Conclusion: For a trip to Hokkaido in 2026

The introduction of an accommodation tax across Hokkaido in 2026 will mark a major turning point in Japanese local government.

The next time you book a trip or check out of a hotel, take a moment to pay attention to the words "accommodation tax" on your bill. Those few hundred yen could be a baton for the future that will protect the breathtaking scenery you were so impressed by and support the lives of the people who live in that area.

Related Links

- Ministry of Internal Affairs and Communications | Local Tax System | Non-statutory Tax

- Tokyo Metropolitan Government Tax Bureau | Accommodation Tax

- Kyoto City Information Center | Kyoto City Accommodation Tax

- Hokkaido | Hokkaido Accommodation Tax

- Toyako Town | Accommodation Tax (Movement to Enact Ordinance)

Inquiries and requests

We help solve local issues.

Please feel free to contact us even if it is a small matter.