〜Local governments' "CFO-like management perspective" and the right answer for sustainable area management〜

*This article is based on the market environment and publicly available data as of December 2025.

"Creditors have better memories than their debtors." These words, left behind by Benjamin Franklin, one of America's founding fathers, resonate with us in 2025 with a colder reality than ever before.

The era of ultra-low interest rates and a deflationary economy, which has long supported Japan's real estate market and public investment, is quietly but surely drawing to a close. With 2025 as a watershed year, Japan is once again returning to a world with interest rates. This represents a vital paradigm shift not only for individual households with mortgages, but also for the management of cities, which must construct huge buildings and maintain and update their infrastructure.

Until now, urban development has relied on the "leverage model," which leverages cheap financing (debt) to anticipate future growth. However, with construction costs soaring and capital costs (interest rates) rising, this premise is beginning to crumble. In this new economic phase, the success or failure of city management depends on the sophisticated integration of three elements: "tax," "interest," and "urban planning."

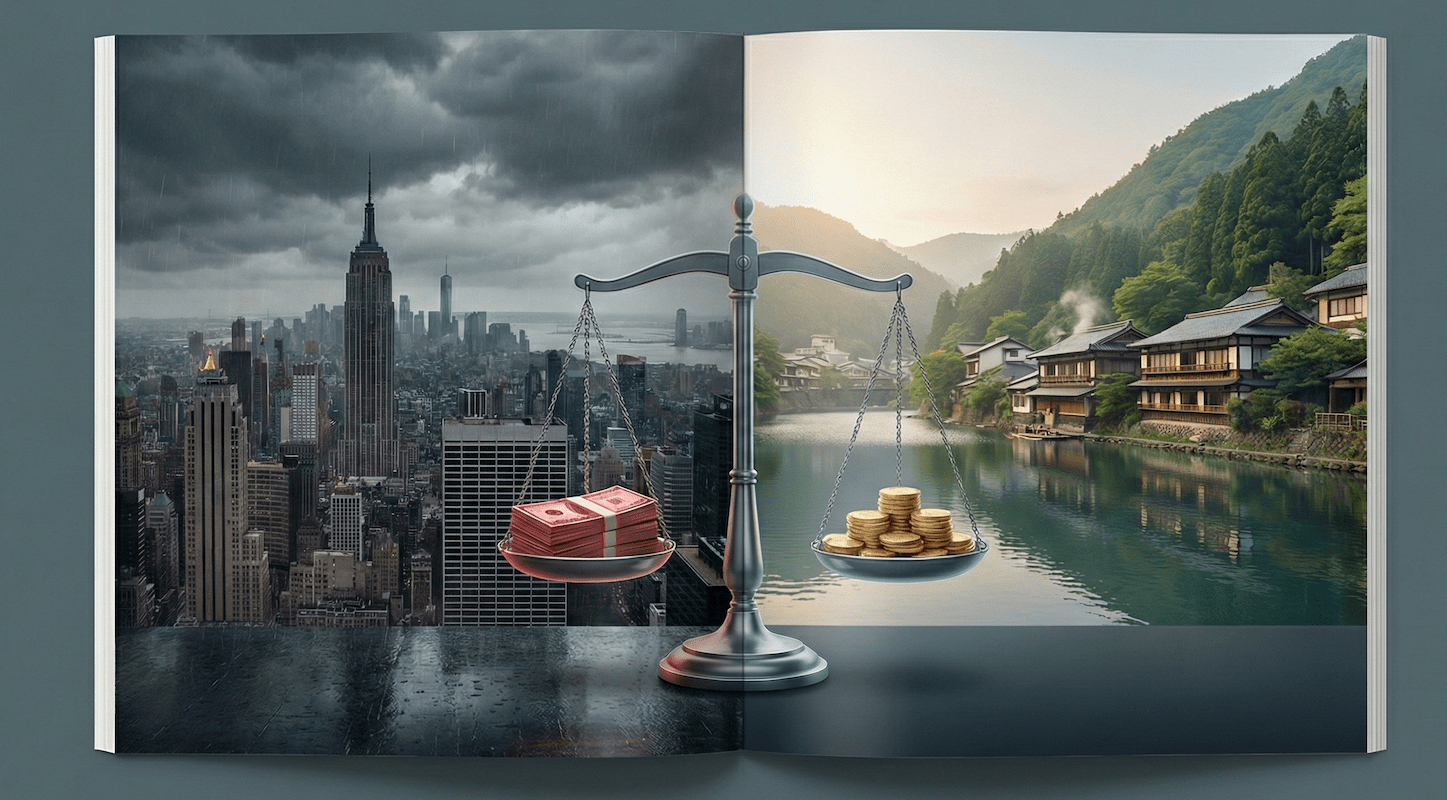

This article examines the lessons learned from New York's Hudson Yards, a notorious example of a failed urban development finance project, and the challenges faced by Toyako Town in Hokkaido, which has achieved solid results. What emerges from this is the survival strategy of local governments in an era of rising interest rates and the importance of a profitable tax system.

1. Debt Trap: New York's Hudson Yards Demonstrates the Vulnerability of TIF

Mechanisms for using future tax revenues "now" and their pitfalls

In urban development, one fundraising method that has become widespread worldwide, particularly in Europe and the United States, is "TIF (Tax Increment Financing)." At first glance, this mechanism seems very rational. Specific development areas are designated, and local bonds are issued today, secured by the future increase in property tax and other tax revenues (increments) that will result from redevelopment, to raise funds for infrastructure development.

In theory, this method is "self-financing," and its greatest appeal has been that it does not impose any additional burden on existing taxpayers. However, this model imposes two extremely strict conditions on the variables of "interest rates" and "economic growth rate." The frightening nature of this was vividly demonstrated by the massive redevelopment project "Hudson Yards" on the west side of Manhattan.

The Lehman Shock Exposed the "Reverse Leverage"

The special purpose company (HYIC) responsible for the infrastructure development of Hudson Yards (extending the 7 subway line and developing parks) issued bonds totaling approximately $3 billion. Mayor Bloomberg at the time claimed that the project would not rely on the city's general fund and that the debt could be repaid solely through development revenues.

However, the Great Recession of 2008 completely destroyed this optimistic assumption. Due to the stagnation of the real estate market, the revenue of $1.9 billion that was expected in 2006 by 2018 actually amounted to just $556 million. This was only about 301 TP3T of the initial forecast, and in monetary terms,The result is approximately $1.3 billion lower (over 70%)This is what happened.

▼ Risk structure of the TIF model (image)

*During a recession, development slows down and tax revenues stagnate, while interest burdens become a heavy burden, with the difference becoming a debt for local governments.

As a result, New York City was forced to provide hundreds of millions of dollars in interest support from its general fund to avoid default. Furthermore, the city also faced a self-contradiction: the huge tax breaks it had offered developers to attract development actually reduced the tax revenues that were supposed to fund the repayments.

This case shows how risky gambling it is to take on "certain current liabilities" secured by "uncertain future cash flows" in an environment of rising interest rates.

2. British Wisdom: London's Battersea Power Station Hybrid Strategy

The best mix of tax revenue and development charges

On the other hand, the redevelopment of Battersea Power Station and the Northern Line Extension (NLE) in London have adopted a more risk-diversifying approach that could be called a "hybrid TIF."

The UK government designated the area as an "Enterprise Zone" and allowed increased revenue from business rates to be used to repay infrastructure. However, the true value of the London model is that it did not rely solely on tax revenue.

- S.106 Agreement (Section 106): A contract that requires developers to directly cover part of the infrastructure development costs in exchange for urban planning permission.

- CIL (Local Infrastructure Levy): The levy is based on floor area and will be used to develop a wide-area transportation network.

In this way, London is hedging the risk of public funds by combining not only "future tax revenues" but also "direct contributions (immediate funds) from developers." This can be said to be a more solid financing model that thoroughly adheres to the principle of beneficiary payment.

3. Japan's chances of success: Hokkaido's "profitable tax system" and capital accumulation

So far we have looked at large-scale projects overseas, but let's shift our focus to Japan, specifically Hokkaido. With Japan's declining and aging population, where can we find the funds to manage our cities? Hokkaido's answer is the strategic use of a non-statutory special-purpose tax to capture the external economy of tourism.

Hokkaido and Sapporo City have made a major shift towards introducing an accommodation tax from 2026 (Reiwa 8). The expected tax revenue is approximately 4.48 billion yen per year for the whole prefecture, and approximately 2.7 billion yen for Sapporo City alone, for a total ofApproximately 7 billion yenreaches.

What's important is that this is "interest rate risk-free equity capital." Because it's not borrowed money (borrowed capital), it's not affected by rising interest rates. Cash is obtained directly from tourists and reinvested in tourism digitalization and improving the appeal of national parks. It's a cycle that generates the capital to increase the value of the region through our own efforts, without relying on debt.

Even more noteworthy is Toyako Town's use of the hot spring tax. The town collects about half of its annual hot spring tax revenue of about 120 million yen, or 62.1 million yen (FY2022).Accumulating funds as a "Tourism Development Fund"I am.

Instead of spending it all in a single fiscal year, they build up internal reserves. This "municipal version of cash-rich management" is the strongest bulwark against unforeseen events such as rising interest rates or natural disasters. In corporate management terms, it is the very definition of a high-quality company that maintains a high profit structure without debt.

Comparative analysis: structural differences in risk and return

The difference in resilience in an era of rising interest rates is crucial between a "debt-dependent" type like Hudson Yards in New York and a "retained earnings" type like Toyako Town. The table below summarizes this.

| Comparison items | [Loan dependent type] Hudson Yards in New York, etc. |

[Internal reserve type] Toyako Town, Hokkaido |

|---|---|---|

| Funding sources | Secured against future tax revenue projections "Bond issuance (debt)" |

Tourists drop "Accommodation tax and bathing tax (cash)" |

| The impact of rising interest rates | Fatal (High Risk) Increased interest payments are putting pressure on finances, It makes the project unprofitable. |

Minor/Unrelated (Low Risk) In principle, no borrowing is done, and the funds are provided by tax revenues on hand. No interest rate risk for investment. |

| Recession resistance | Vulnerable. Delays in development = insufficient tax revenue, Public funding (rescue) is inevitable. |

Robust. The provident fund acts as a buffer, Investment and maintenance can be continued even during recessions. |

Reinvesting in the intangible asset of "landscape"

So, what exactly is the tax money being used for? A detailed analysis of Toyako Town's fiscal year 2022 financial statements reveals its strategic nature.

Rather than building flashy structures, the funds are being used to maintain water quality by installing a sewer system (approximately 18.5 million yen), maintaining walking paths (approximately 5.12 million yen), and providing amenities such as footbaths (approximately 4 million yen).These may seem unassuming at first glance, but they are essential costs for maintaining the region's brand value (intangible assets) of a "highly transparent lake" and a "comfortable hot spring town."

Investment guru Warren Buffett once said, "Price is what you pay, value is what you get," and this is certainly an extremely wise expenditure (Capex) that will enable the region to continue to gain "value."

4. Market Analysis: The 2025 Crisis and the Conditions for a "City of Choice"

Rising construction costs and the beginning of a shakeout

Turning our attention to the private market in 2025, the construction and real estate industries are facing unprecedented headwinds. In addition to rising material prices due to the weak yen and global inflation, labor shortages stemming from the "2024 Problem" are causing construction delays and rising labor costs. Worst of all, the combination of the start of repayment of zero-zero loans and rising interest rates has led to the number of bankruptcies in the construction industry on track to surpass 1,000 for the first time in 12 years.

The naive business plans of the past, which assumed steady growth, such as "If we build it, it will sell" and "If we develop it, people will come," are no longer viable. We have entered an era of "selection" in which only truly profitable projects and truly sustainable municipalities will survive, passing through the strict filter of interest rates.

The potential of the "Japanese version of TIF" and area management

It is precisely in times like these when private sector vitality is being undermined that public sources of funding for urban development (accommodation tax and hot springs tax) become increasingly important. At a time when private developers are hesitant to develop due to being unable to bear the interest burden, if local governments can continue to use their abundant tax revenues (retained earnings) to promote and develop infrastructure, they can support local economic activity and maintain investment enthusiasm.

One potential strategic proposal for the future is a "Japanese version of TIF" approach that expands on the Toyako model. In other words, rather than securitizing uncertain future tax revenues, this method involves area management organizations using a steadily accumulated fund (past tax revenue stock) as seed money to invest in specific priority areas (such as special tourist zones). The cycle of "earn, save, invest" needs to be designed by the public and private sectors working together, with the perspective of a CFO (Chief Financial Officer), rather than being left to the government.

Conclusion: A CFO's Perspective Required for City Management

In the days before interest rates, urban development was only allowed to be discussed in abstract terms such as "dreams" and "hopes." However, in the coming era of rising capital costs, talking about dreams requires a solid financial foundation and meticulous calculations to support them.

The example of New York's Hudson Yards teaches us the vulnerability of excessive leverage, while the example of Toyako Town in Hokkaido shows us the strength of steady tax revenue accumulation. What we can learn from these two lessons is the importance of local governments and regions themselves taking a hard look at their own balance sheets (assets and liabilities) and regaining discipline as managers.

Non-statutory taxes such as accommodation taxes and hot spring taxes are not simply government tax collection methods. They are valuable "capital" that allows regions to become independent and carve out a future unaffected by external changes such as interest rate fluctuations and economic downturns. How wisely can we use this capital and convert it into the next wealth (area value)? The outcome of the inter-city competition from 2025 onwards will depend on the ability to strategically execute this.

Related Links

- Ministry of Land, Infrastructure, Transport and Tourism: Urban Development (Urban Planning and Urban Policy)

- Hokkaido: Consideration of Accommodation Tax

- Toyako Town: Financial Status (Settlement)

Inquiries and requests

We help solve local issues.

Please feel free to contact us even if it is a small matter.