〜Market failure and the path to recovery〜

*This article is based on reliable statistical data and legal reform information as of December 2025.

"Cities are mankind's greatest invention," argued Harvard economist Edward Glaser in his book, "Cities." Cities are places where people gather, exchange knowledge, and generate innovation. However, what is quietly but surely happening in Japan today is the sponge-like nature of urban functions -- in other words, the hollowing out of living space.

During Japan's period of rapid economic growth, the government and private sector worked together to drive the economy by continuously supplying a large number of newly built homes, with the national policy of "eliminating the housing shortage." A "detached home with a garden" was the dream of the middle class, a sign of hard work, and most importantly, it was believed to be a surefire way to build assets. However, with the current accelerating population decline and aging society, this "logic of yesterday" has completely collapsed, causing huge distortions in the market. The supply and demand balance has completely reversed, and homes, once considered "assets," are now being transformed into "negative assets" that only require maintenance costs.

The latest survey results released by the Ministry of Internal Affairs and Communications have revealed a shocking fact: the number of vacant homes remaining in Japan has topped 9 million, a record high. This is far more than the total number of households in Tokyo (approximately 7.36 million), and we have no choice but to call this no longer a passing phenomenon, but a structural problem at the national level.

Why are so many houses left to decay quietly without being sold or rented? This goes beyond simple demographic issues and is due to a complex intertwining of Japan's unique "structural rigidity." The harsh reality of earthquake-prone Japan, the economic rationale that has forced real estate agents to shy away from vacant house transactions, and the paradox of a tax system that encourages owners to "abandon" their properties.

In this article, we will analyze these invisible barriers from various angles, including the latest legal reform trends for 2023 and 2024, and the example of Toyako Town in Hokkaido, which is facing a harsh natural environment, and explore paths to structural change that will overcome ``market failure.''

1. The shock of the 9 million household era: Statistics reveal "market failure"

First, we need to look squarely at the current situation in Japan from objective data. The 2023 edition of the Housing and Land Statistics Survey, conducted every five years by the Statistics Bureau of the Ministry of Internal Affairs and Communications, is a report card that harshly shows that Japan's housing policy to date has reached its limits.

Accelerating stock accumulation and international heterogeneity

As of October 1, 2023, the number of vacant houses in Japan will be 9,002,000 households This is an increase of more than 510,000 houses compared to the previous survey (2018), meaning that over the past five years, the number of newly vacant houses equivalent to twice the total number of houses in Tottori Prefecture (approximately 260,000 houses) has become vacant. Despite the population entering a phase of decline, the pace of increase in vacant houses is accelerating rather than slowing down.

Even more serious is the "vacant house rate." The percentage of vacant houses in the total number of houses is 13.8% This is the highest figure ever recorded. This is an abnormal situation in which approximately one in seven homes in Japan is vacant. While this may not be readily apparent in urban areas, in rural areas, particularly in parts of Shikoku and Chugoku, it is not uncommon for vacant home rates to exceed 20%, and even the sustainability of communities is in jeopardy.

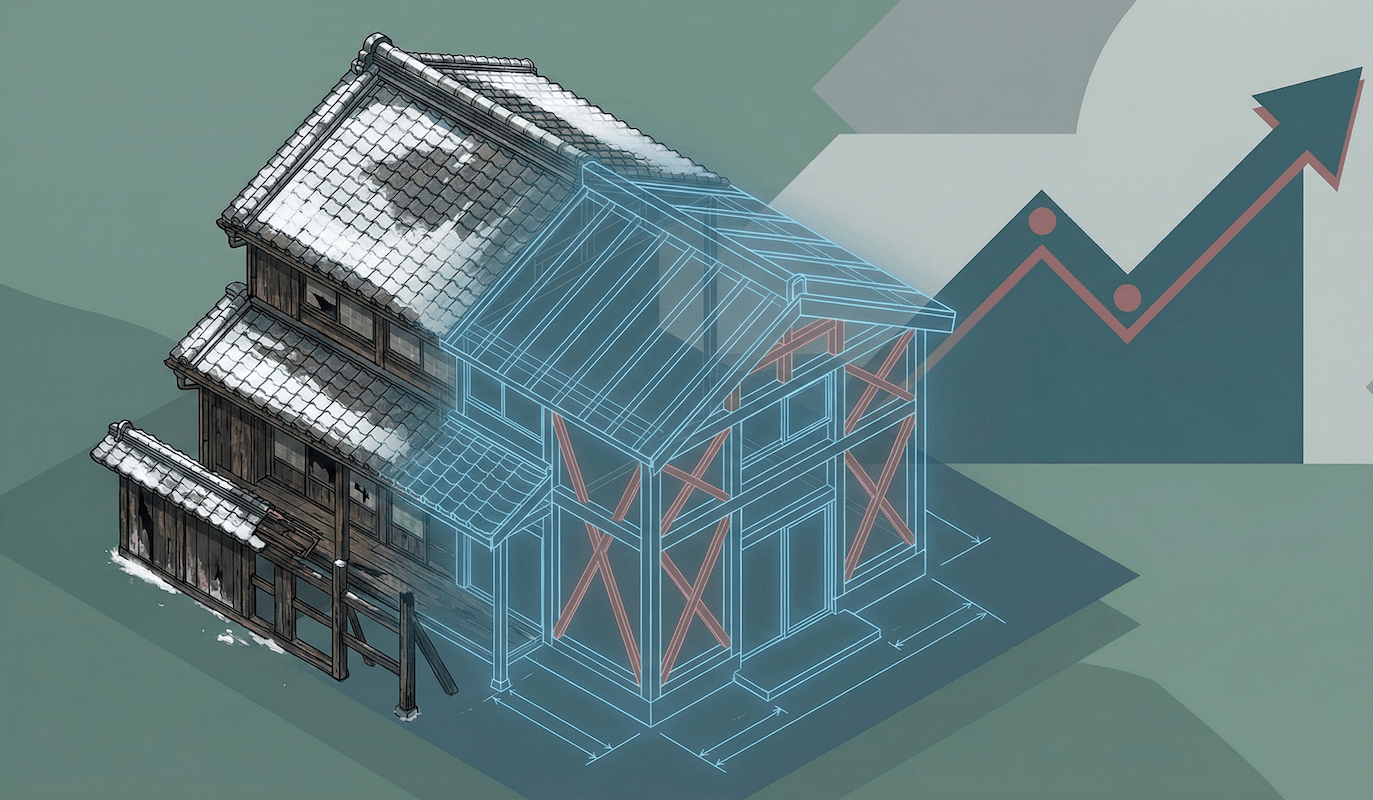

[Illustration] Changes in the total number of vacant houses in Japan (unit: 10,000 houses)

~Accelerating pace of increase~

*As of October 1st of each year. Figures for 2023 are final. Source: Created based on the Ministry of Internal Affairs and Communications' "Housing and Land Statistics Survey."

3.85 million homes isolated from the market: a "black box"

What is more important than the total number of vacant homes is the breakdown of their quality. Statistically, vacant homes are broadly classified into four categories: "homes for rent," "homes for sale," "secondary homes (vacant homes, second homes, etc.)," and "other homes."

Vacant houses for rent or sale are circulating in the market but have an aspect of being "inventory" that happens to have no tenants or buyers. If the price mechanism works, this may eventually be resolved. However, the core of the problem is that they are completely left behind by the market mechanism."Other housing"is located.

| Types of vacant houses | Number of units in 2023 | Definition, nature and social impact |

|---|---|---|

| For rent or sale | 4.76 million households | Inventory properties that are circulating on the market but have no tenants or buyers. They function as a regulator of supply and demand, but excess inventory can cause real estate prices in the entire region to fall. |

| Other housing | 3.85 million households |

These are properties that are neither for sale nor rent and are left abandoned. In most cases, they are poorly managed due to hospitalization, death, relocation, etc. ▶︎This is the main cause of "negative assets" that bring disaster prevention, crime prevention, and hygiene risks (external diseconomies) to the region, and is the area where government intervention is most needed. |

Shockingly, approximately 3.85 million homes have not even entered the market. This is an increase of approximately 370,000 homes since 2018. Many of these properties are left abandoned because their owners are aging and their judgment skills are declining, or because inheritances have occurred but negotiations for the division of the estate have not been concluded. In particular, linked to the issue of unowned land, there is an increasing number of properties where it is unclear who is responsible.

In other words, the "void" in the owner's life is directly reflected as a "void" in the urban space. This is a classic example of what economics calls "market failure," and if left to its own devices (market principles), the situation will only get worse.

2. The fate of an earthquake-prone country: the "invisible wall" of earthquake resistance standards

Why are Japanese homes not accumulated as "assets" like in the West, but instead "consumed" in a short space of time? Behind the commonly-cited Japanese psychological bias of "faith in new construction," there is an unavoidable physical and legal reason for Japan being one of the world's most earthquake-prone countries. This is the issue of "earthquake resistance standards."

The older a building is, the more valuable it becomes as a "vintage" building - and this is the crucial reason why such Western values are difficult to apply in Japan.

The watershed moment of 1981: the fatal risks posed by "old earthquake resistance"

In Japan's used housing market, the most important dividing line that determines the value and safety of a property is June 1, 1981 (Showa 56). Learning from the devastating damage caused by the 1978 Miyagi Prefecture offshore earthquake, the Building Standards Act was drastically revised and earthquake resistance standards were significantly strengthened.

There is a huge difference in structural safety between houses built under the "old earthquake resistance standards" that were established before this, and houses built under the "new earthquake resistance standards" that were established after this. Specifically, the old standards aimed to "not collapse in an earthquake of magnitude 5 or higher," while the new standards aim to "not collapse in an earthquake of magnitude 6 or higher to 7 or higher."

This difference is brutally proven by actual disaster data. Data from the 1995 Great Hanshin-Awaji Earthquake shows that of all wooden houses that suffered severe damage or worse, more than 90% were built to the old earthquake resistance standards. Also, in the 2016 Kumamoto earthquake, the collapse rate of wooden houses built to the new earthquake resistance standards (especially the current standards that were further strengthened in 2000) was extremely low, while buildings built to the old earthquake resistance standards had a high probability of collapsing.

Cost barriers that prevent renovation

In Europe and the US, particularly in the UK where the risk of earthquakes is low, brick houses over 100 years old are passed down through generations with frequent maintenance. However, in Japan, wooden houses over 40 years old that are no longer earthquake-resistant are not only attractive, but also pose a high physical risk to life.

To eliminate this risk and make the house safe to live in, large-scale earthquake-resistant renovation work is essential, including reinforcing the foundation, adding braces, expanding walls, and lightening the roof. However, even here, financial obstacles stand in the way.

[Seismic Retrofitting Dilemma: Imbalance of Costs and Benefits]

- ▶︎ High renovation costs:The average cost of retrofitting a typical wooden house to make it earthquake-resistant is said to be between 1.5 million and 3 million yen, and depending on the condition and size of the property, it is not uncommon for the cost to exceed 5 million yen.

- ▶︎ Lack of reflection in asset values:Even if a large amount of money is spent to improve earthquake resistance, in most cases, especially in rural areas, the increase in resale value (resale value) that justifies the cost cannot be expected. This is because buyers still have a strong tendency to prefer "vacant lots" or "new construction" over "renovated" properties.

- ▶︎ Conclusion: "Leave it alone"As a result, owners decide that they will not be able to recoup their investment even if they spend several million yen on repairs, and yet they are unable to afford the cost of demolishing the property and clearing the land (which would also be around 1 to 2 million yen), and are forced to make the risky decision of leaving the vacant house ``stale.''

In other words, Japan's "scrap and build" policy is not simply the result of consumer culture and corporate profit-seeking; it cannot be denied that it is also an attempt to update safety standards to protect the lives of the people. This issue of earthquake resistance is the highest and thickest barrier to distribution, unique to Japan and not found in other countries.

3. Structural flaws in the real estate business: "Economic rationality" keeps businesses from taking action

Even if the owner of a vacant house decides to sell and consults with a local real estate company, many of them have been reluctant to help. This is not due to negligence on the part of the company, but rather the result of extremely rational economic behavior stemming from the profit structure of the real estate distribution business itself.

The limit of "3% + 60,000 yen": A vacant house transaction that is sure to result in a loss

The "brokerage fee (remuneration)," which is the main source of revenue for real estate agents, is strictly capped by law (the Real Estate Transaction Business Act). For a long time, the calculation formula for this fee was, in principle, as follows, depending on the purchase price (a simplified calculation formula that is widely known is "purchase price x 3% + 60,000 yen + consumption tax").

- ・Parts under 2 million yen: 5%

- ・Over 2 million to 4 million yen: 4%

- ・Over 4 million yen: 3%

For example, let's say you've managed to sell an old, vacant house in a rural area for 1 million yen after much effort. In this case, the maximum commission the real estate agent can receive from the seller is 1 million yen x 5% = 50,000 yen (excluding tax). Even if you find a buyer and the transaction becomes a double-dealer deal, the total will be 100,000 yen.

However, the practical costs of real estate transactions are not proportional to the property price. The time and effort required for a series of tasks, such as on-site property surveys, legal investigations at government offices, confirmation of rights, and preparation of contracts and important information documents, is not significantly different whether it's a 100 million yen apartment or a 1 million yen vacant house. In fact, the older the vacant house, the more complex the rights, with unclear boundaries and owners listed on the land registry still born in the Meiji era, and the more time and effort required for investigations.

"The more seriously we try, the more we lose money." This was the structural reason why real estate agents on the ground shied away from cheap vacant house deals and were forced to gently decline over the phone.

Major changes to compensation rules in July 2024: Will this be the trigger that moves the market?

In order to resolve this bottleneck in the business structure, the Ministry of Land, Infrastructure, Transport and Tourism finally took the plunge and made major revisions to its compensation regulations. The new regulations, which came into effect on July 1, 2024, include the following:"Affordable vacant houses, etc."The special provisions for brokerage fees for the sale and purchase of real estate have been significantly expanded.

| Comparison items | Before the revision (until June 30, 2024) *After the special provisions were introduced in 2018 |

After revision (July 1, 2024 onwards) *This drastic revision |

|---|---|---|

| Maximum price of eligible property | Under 4 million yen | 8 million yen or less (double the target) |

| Special fee billing destination and upper limit |

Only from sellerBillable. Maximum: 180,000 yen + consumption tax |

From both sellers and buyersBillable. Maximum: 300,000 yen + consumption tax each (maximum total of 600,000 yen + tax) |

| Market Implications | The buyers' compensation remained low, there was a lack of incentive for buyers, and the effect of promoting distribution was limited. | By setting a compensation level that covers actual expenses and ensures a fair profit, it is expected that real estate agents will enter the market and engage in active sales activities. |

This amendment is a measure that officially recognizes the benefits of dealing in vacant houses as a business. The target property has been expanded to 8 million yen, and it is now possible to receive up to 300,000 yen (plus tax) from both the seller and the buyer, dramatically increasing the possibility of running a business even for inexpensive properties in rural areas.

This could change the way real estate agents think, even if they previously thought, "A vacant house worth 1 million yen is just too much work to handle," and think, "If I can make a total of 600,000 yen in commission from the sale, I might be able to make a business out of it if I combine it with renovation proposals." This could be a major turning point that fundamentally reconsiders the "incentive design" that is the lifeblood of the market.

4. Tax Paradox and Changing the "Carrot and Stick" Approach

Even if real estate agents start to take action, the market will not move unless the owners themselves want to sell. However, the biggest motivation for owners to "abandon" vacant homes is a distorted paradox created by Japan's tax system.

As is well known, there is a powerful preferential treatment for land property tax called the "Residential Land Special Exemption," which reduces the taxable amount by up to one-sixth as long as a "house" for people to live on the land. This was originally a measure to protect the people's right to residence and promote home ownership policies.

However, in an era of declining population, this system has become a breeding ground for abandoned vacant houses. The moment a house is demolished and the land cleared at a cost of several million yen, the special exemption is removed and land taxes jump up to six times. Given this, it was only natural that people would decide that it was more rational in terms of cash flow to keep the house in its original form and continue to pay low taxes, no matter how dilapidated it was and how much of a nuisance it caused to neighbors.

The risk of new construction of "poorly maintained vacant houses" and tax increases becomes a reality

In order to put an end to this "paradise of neglect," the government has taken a major institutional axe. The revised "Act on Special Measures Concerning the Promotion of Measures for Vacant Houses, etc." came into effect in December 2023.

Previously, the government could intervene and lift the tax exemption only if the property was certified as a "specific vacant house" that was in imminent danger of collapse. The hurdle for certification was extremely high, and the cases in which it was actually applied were limited. However, the revised law introduces a new step before that."Poorly maintained vacant house"A division was established.

[What is a poorly managed vacant house?]

Vacant houses that are in a state where they may become "specific vacant houses" in the future if left unattended are expected to be in the following states:

- The windows were left broken, allowing anyone to get in.

- Garden trees and weeds are overgrown, crossing over into neighboring land and becoming a source of pests.

- Parts of the roof and exterior walls have begun to peel off, raising concerns that the situation will worsen in the future.

▶︎ Once you receive "guidance" and then "recommendation" from the government, the special exemption for residential land on fixed asset tax (1/6 reduction) will be lifted and taxes will increase from the following fiscal year.

This is a powerful "whip" for owners, as leaving their property unattended directly leads to the risk of a tax increase. The option of "leaving it for now" has now been transformed into an economically risky action. This legal revision is beginning to function as a trigger to forcefully shift owners' mindset from "leaving it unattended" to "managing, utilizing, and disposing of it."

5. Case Study of a Heavy Snow Region: The Challenge of Toyako Town, Hokkaido

So far we have looked at institutional issues at the national level, but the problem of vacant houses is also closely related to the climate, environment, and social conditions of each region.Finally, we will look at the reality and measures specific to local areas, using the example of Toyako Town in Hokkaido, which has tourist resources but faces the harsh conditions of depopulation and heavy snowfall.

In areas with heavy snowfall such as Hokkaido and the Tohoku region, vacant houses are not just unused assets but are transformed into "hazardous materials" during the winter. In occupied homes, snow melts and slides off due to heating, but in vacant houses without heating, snow continues to accumulate.

The load can reach several tons or even tens of tons, easily exceeding the structural strength of an old wooden house. As a result, the eaves may collapse, and in the worst case, the building may collapse completely. There is also the constant risk of liability for damage caused by snow falling from the roof, damaging neighboring houses or injuring passersby.

Even if the owner lives in a remote area, they must continue to bear the burden of snow removal costs and management fees of hundreds of thousands of yen every winter. Furthermore, for buyers, it is difficult to predict the future maintenance costs of an "aging property that requires snow removal," and this is a crucial physical and psychological barrier preventing the property from being sold.

In this harsh environment, Toyako Town is not just encouraging people to settle there, but is also designing its own unique incentives to encourage people to use the town as a "commerce hub" that takes advantage of its unique characteristics as a tourist destination.

At the heart of this initiative is the "Challenge Shop Support Project Subsidy," which provides generous support to entrepreneurs who are opening retail, service, or restaurant businesses in vacant houses or stores within the town.

- ● Renovation cost assistance:Subsidies are available up to half of the eligible expenses, up to a maximum of 500,000 yen, reducing the burden of initial investment and lowering the hurdles to renovation.

- ● Rent subsidy:The government will subsidize up to 50,000 yen per month in the first year of business, and up to 30,000 yen per month in the second year. The government will share the risk of fixed costs during the start-up period when business management is unstable.

As the population declines and demand for residential use declines, local governments are encouraging the conversion of these properties into "profit-generating real estate" such as stores, private lodgings, and co-working spaces, and are exploring sustainable business models that can absorb the high maintenance costs. This means moving away from the concept of a "house just for living in."

Conclusion: Roadmap for structural transformation: From "flow" to "stock"

The number of 9 million vacant homes is conclusive evidence that the Japanese housing system, which has traditionally been based on building and demolishing homes, has reached its limits. The inevitable risk of earthquakes, the flaws in the business structure of real estate agents' fees, and the paradoxes of the tax system have all intertwined in a complex way, causing the market's automatic adjustment function to malfunction.

However, it's not all pessimistic. With the "stick" (risk of tax increases) of the Vacant Houses Act amendment in 2023 and the "carrot" (expansion of business opportunities) of the agency fee revision in 2024, the once rigid market is now on the verge of a major turning point. The government is seriously trying to rewrite the rules of the market.

Looking ahead, the market will clearly become polarized. With new construction prices soaring, properties that are well-located, earthquake-resistant, and properly managed and renovated will be reassessed as "wise choices," and circulation will likely increase. On the other hand, properties in poor condition, with complicated rights relationships, and left poorly managed will be completely abandoned by the market and will ultimately be forced into public liquidation through administrative execution or the system of inherited land being transferred to the national treasury.

What is required of each and every one of us now is a paradigm shift in our awareness. From a flow-based mindset that says, "Building a new house is the end of it," to a stock-based mindset that says, "Properly evaluate what you have, maintain it, and circulate it." Owners must take responsibility for their assets, real estate agents must propose new value, and the government must put in place systems to support this. This trinity of change is the only way to transform the "negative legacy" of vacant houses into a "rich resource" for the next generation.

Related Links

- Ministry of Land, Infrastructure, Transport and Tourism: Revision of the amount of remuneration that real estate agents can receive for the sale and purchase of land or buildings (Ministry of Construction Notification No. 1552 of 1970)

- Statistics Bureau, Ministry of Internal Affairs and Communications: 2023 Housing and Land Statistics Survey

- East Japan Real Estate Transaction Organization: Trends in the Tokyo Metropolitan Real Estate Distribution Market

Inquiries and requests

We help solve local issues.

Please feel free to contact us even if it is a small matter.